2.6. Spotlight on Immunity

With all of the territories covered, there is one area that requires specific attention due to the specific circumstances that the world has experienced during 2020 and 2021.

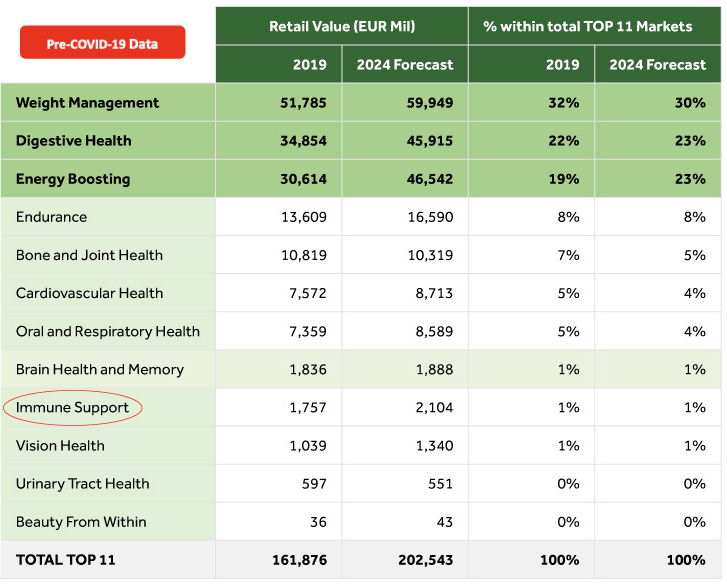

Despite being a territory relatively much smaller in size, immune support is expected to become an increasingly important attribute for global consumers in the post-COVID-19 era.

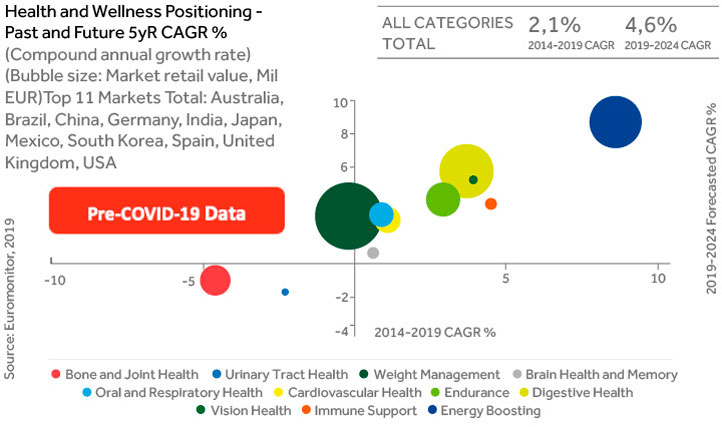

Table 1. All Health and Wellness (except Free From and General Wellbeing).

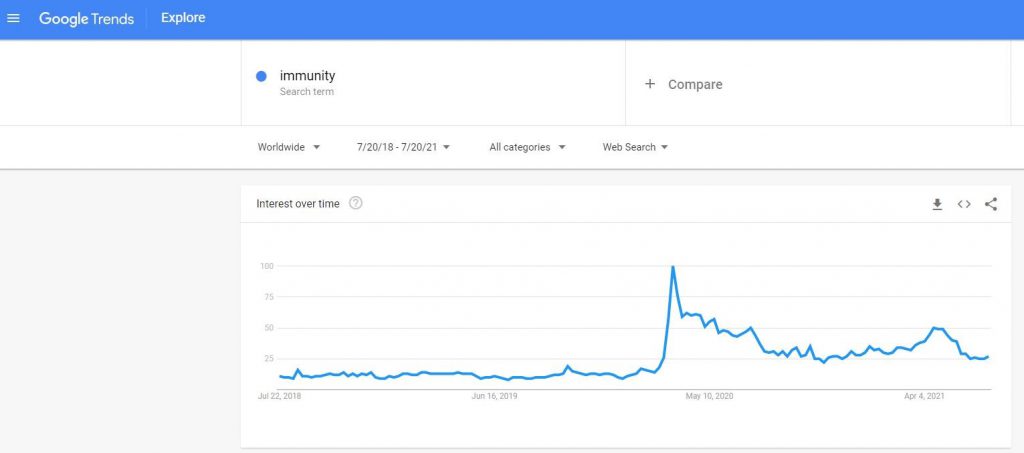

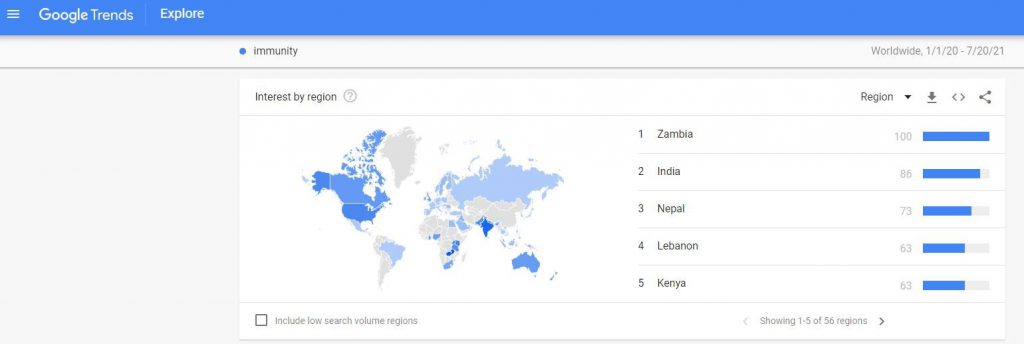

Google searches of the term “immunity” have remained consistently and relatively higher even one year since the pandemic began and searches spiked in March 2020. Although search interest has dropped since March 2020, it has stabilized at a significantly higher mean than pre-pandemic searches, meaning there is likely a prolonged interest in this topic.

According to Mintel, COVID-19 and the concern over other possible future pandemic diseases will fuel demand for immune-health-focused products.

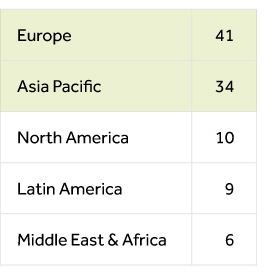

In the last five years, Europe and APAC have had the highest percentage of launches in healthcare, food and beverages with an immunity claim (Table 10).

Table 10. Percentage (%) of food, drink & healthcare launches featuring immunity-enhancing functional claims. By region, April 2015-March 2020.

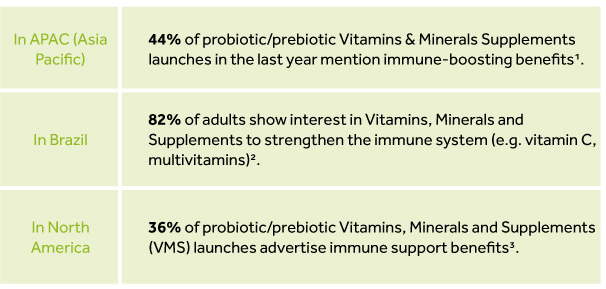

The trend in Vitamins & Minerals Supplements (VMS) also confirms the interest in immunity. Mintel GNPD1 data shows that although the innovations in products with energy support claims have driven the new product development and enjoyed fastest growth, with the COVID-19 crisis, it is immune system claims that are set for rapid growth going forward, as people turn to renowned immune support vitamins C and D and minerals, such as zinc, to help fight off infection and keep bodies healthy.

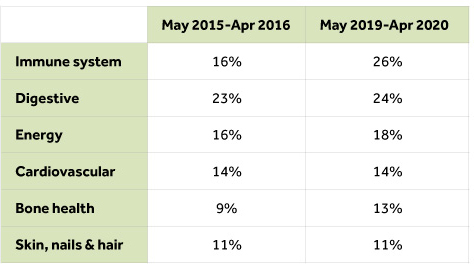

Table 11. Europe: VMS innovation by top six functional claims, 2015-16 vs 2019-20 (based on the top six most active functional claims in 2019-20 period; excludes functional-other claim).

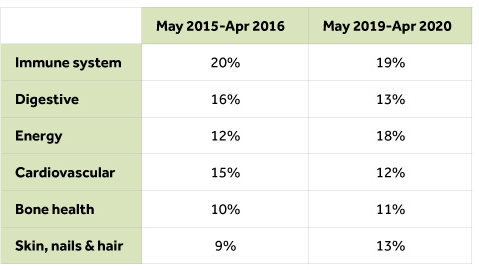

Table 12. APAC Region: VMS innovation by top six functional claims, 2015-16 vs 2019-20 (based on the top six most active functional claims in 2019-20 period; excludes functional-other claim).

In the APAC region immunity already drives functional new product development in the Vitamins, Minerals and Supplement (VMS) category and is set for high growth going forward (in contrast to flat past activity).

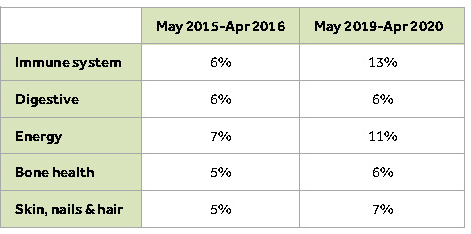

Table 13. Latin America: VMS innovation by top six functional claims, 2015-16 vs 2019-20 (based on the top six most active functional claims in 2019-20 period; excludes functional-other claim).

REFERENCES

- Mintel Global New Product Development (GNPD), 2020.

- Lightspeed/Mintel. Base: Brazil: 1,500 internet users aged 16+.

- Mintel Global New Product Development, 2020.