2.3. Spotlight on digestive health

INTRODUCTION

Increasing interest on gut health

The big focus is on digestive health but due to the gut-brain axis it impacts not only physical health but also mental wellbeing. Consequently, not only are consumers interests, but also the food and drink industry.

Functional food overcome supplements

Due to an ageing society, health issues arise, which means that consumers opt for more natural products as a preventative solution to staying healthy.

Fermented products increase on sales

Surprisingly, consumers have encountered the health benefits of products such as kefir and kombucha. These fermented products have been popular on the following markets: US, Australia and the UK.

Probiotics growing on snack category1

Consumers are more in favor of probiotics in snacking categories because it allows them to indulge while having health properties.

MARKET COMPARISON

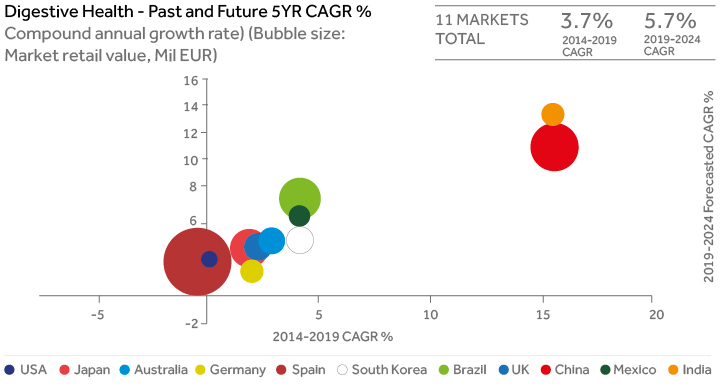

Figure 4. Digestive Health – Past and Future 5YR CAGR% (Compound annual growth rate) (Bubble size: Market retail value, Mil EUR).

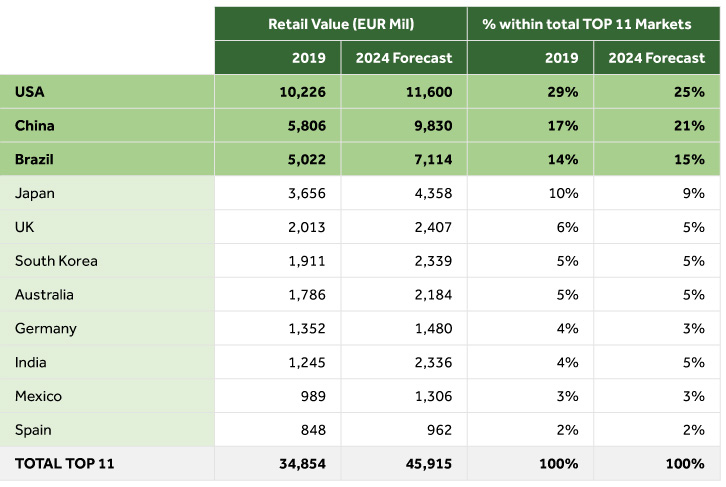

Table 3. Digestive Health.

USA, China, and Brazil are respectively the largest markets for Digestive Health.

In 2019, USA made up 29% of the category.

In 2024, the weight of the USA in the category is expected to drop to 25%, whereas the weight of China will increase by 4% points to 21%.

China will be the second fastest growing market after India.

The size of the category in India is very small despite of the fast growth rate.

A. Country Highlight – USA2

Stress and unhealthy eating increase the sales of digestive health products

Americans report that since they have such a stressful life and unhealthy eating habits, digestive health products help with their overall wellbeing. Even if they know that an unhealthy diet may have consequences on the long-term, they would rather self-medicate.

Digestive health focused on the microbiome

The concept of digestive health is no longer related to mostly Over-the-counter (OTC) products, as it traditionally was. Right now, it is shifting to a more organic diet focused on microbiomes and probiotics which are more preventive.

Also, innovation has made these products more affordable which is another reason why consumers prefer these kinds of treatments rather than traditional medications to alleviate digestive discomfort.

B. Country Highlight – China3

In China, probiotics have also increased in share since brands have been promoting it; influencers (doctors/opinions leaders) have spread the word of its benefits and it’s now a product that Chinese consumers are willing to try since it claims that is healthier on the long-term.

Dietary products are expected to be increasing sales because they are leaning on prevention which is really important for the Chinese culture.

C. Country Highlight – Brazil4

These are some of the issues that are affecting Brazilians digestive health and despite the desire of following a healthy diet is increasing, they keep promoting their unhealthy habits.

- High consumption of sugar-based drinks

- Coffee

- Processed foods

- Lack of sufficient intake of fiber

- Higher stress levels

Poor dietary habits affect digestive health

Euromonitor´s data on soft drinks show that per capita consumption of carbonates in the country

stands at 61 liters, while the global average is 29 liters.

Euromonitor´s data on health and wellness show that items with high fiber content are also losing presence on shelves. Value sales of items containing such claims posted a CAGR of –12% over 2013-2018.

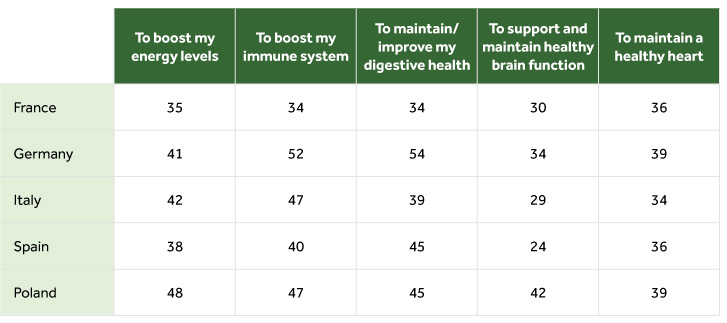

CONSUMER ATTITUDES

Consumers are aware that food and drink can impact their digestive health. In fact, it’s one

Table 4. Select European countries:

motivation for using functional food and drink, 2018 (% agree).

67% people aged 20-49 in China who have drunk lactobacillus in the last six months did so to help digestion5.

13% of Brazilian consumers agree that having probiotics added is an important attribute when choosing a non-alcoholic blurred beverage6.

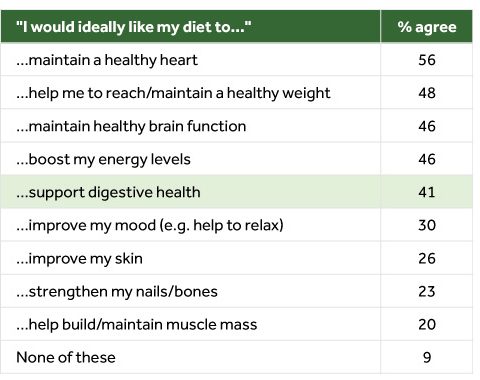

For UK consumers it’s also one of the benefits they expect from an ideal diet (Table 5).

Table 5. Benefits that UK consumers would ideally like from their diet, November 2019. “I would ideally like my diet to…“.

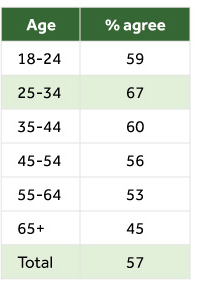

In a research in the US on consumer approach to nutrition and diet, 57% of adults stated that they try to eat foods that encourage a healthy gut/microbiome. The percentage goes up to 67% in people aged 25-34 (Table 6).

Table 6. Eat foods that encourage a healthy gut, by age, November 2019. “How much do you agree or disagree with the following statement: I try to eat foods that encourage a healthy gut/microbiome”.

REFERENCES

- Opportunities in Gut Health: Dairy and Beyond, Euromonitor, 2019.

- Digestive Remedies in the US, October 2019.

- Digestive Remedies in China, October 2019.

- Digestive Remedies in Brazil, February 2020.

- Lactobacillus Beverages in China, Mintel, April 2019.

- Beverage Blurring – Consumer needs and how they can influence the industry, Mintel, Brazil, January 2019.