4.1. Almonds

![]()

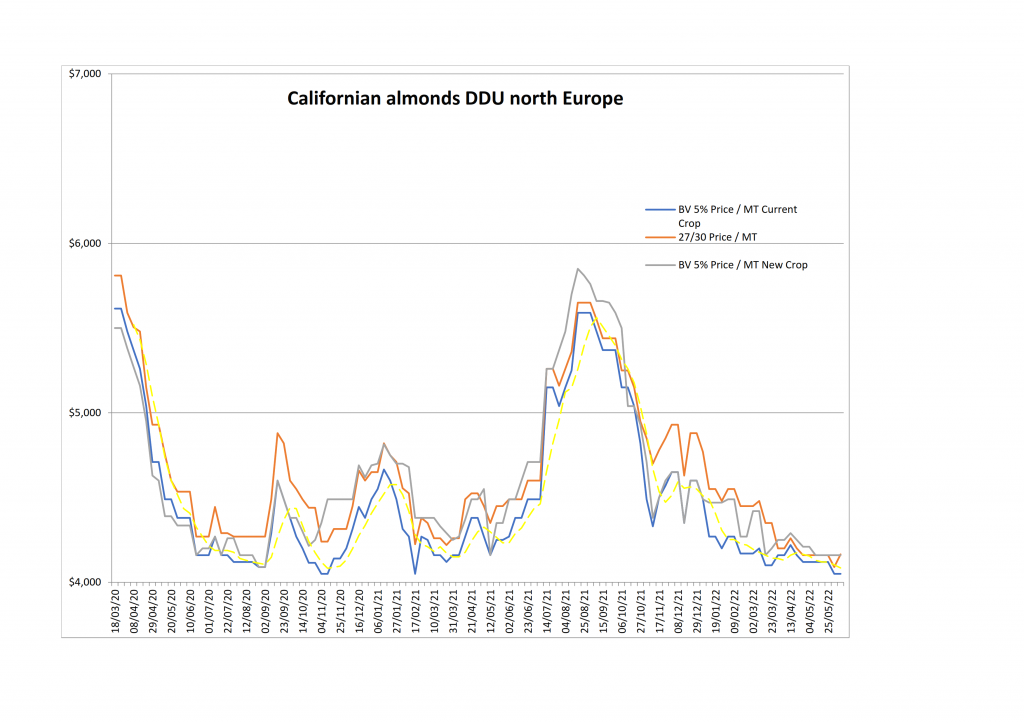

Although almonds are not exchanged “technically” and charts might be considered of no merit, a technical analysis of Figure 8 would suggest that prices may be moving in the direction of reversing the longer-term trend. When looking at the price movement, specifically since the beginning of the pandemic (Figure 8b), it is heading towards what is known as a “head and shoulder” trend reversal pattern.

Figure 8. California Almonds Delivered Duty Unpaid (DDU) North Europe (USD). (a) 10-year series (August 2012-April 2022); (b) since the beginning of the pandemic (March 2020-May 2022).

The Almond Board of California June 2022 position report (published on July 12, 2022), shows that while year-to-date shipments continue to lag 7.65% from last season (2.5 million pounds vs. 2.7 M lbs.), over 278 M lbs. were shipped during the month, up by 26% from the June 2021 record. This is not only the biggest shipping month of the crop-year so far, but is the second largest shipment month in the history of the almond industry. As the availability of shipping for exporters keeps improving for the second consecutive month, the initially huge carryout predicted for almonds is decreasing. Since a strong July shipment report is anticipated to close out the crop year, carryover is expected to end up around 750 M lbs.

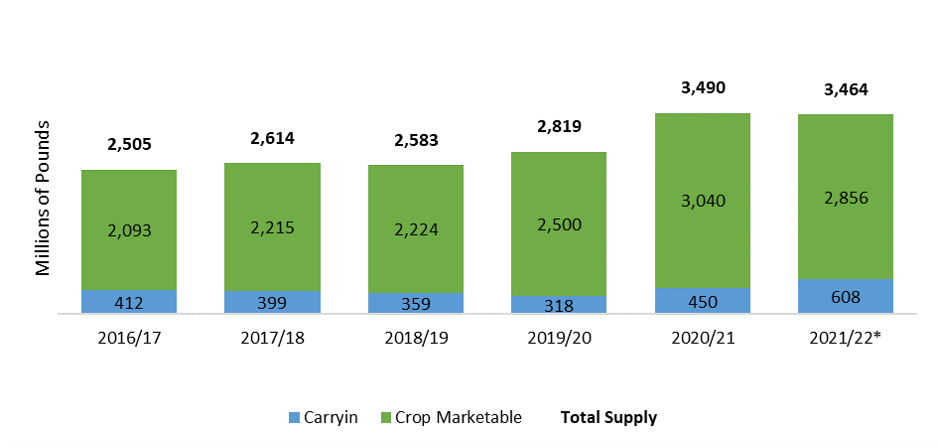

With a high stock ratio of 25-30%, it should not come as a surprise that almonds are so inexpensive. As prices rise in response to decreased supply and/or higher demand (Figure 9a), a decrease to a more normal 20% stock ratio could be expected over the following couple of crop years. This is perhaps the reason why so many “Consumer Packaged Goods” (CPG) companies that use almonds are attempting to extend almond coverage as far in advance as possible, often on multi-year contracts.

When compared to the prior year, June shipments to India, Western Europe, and the UAE increased significantly. Over the last few months, India has been actively buying to guarantee stock for festival sales since this year’s Diwali falls early. Since BSU5% and pollinators continue to trade at record low costs, European purchasers keep benefiting from the discount for the present crop to meet their Christmas demands. With sellers in California marketing the rest of their NPX and INDX inventory, traders in Dubai have also been replacing their post-Ramadan stocks.

On the production side, the current drought in California has received a lot of attention –2022 year-to-date has been the driest on record in more than a century. The fact that the price of almonds on the open market is likely at an all-time low “in real terms,” at a time when the cost of water, the average cost of inputs for growers (fertilizer, pesticide, labor, fuel, etc.) has increased dramatically, has resulted in a decrease in orders for almond nurseries and an increase in orchard removal on farms. For these reasons, a decrease in supply during the next two years will be more likely to result in a return to a more typical stock ratio. Furthermore, according to the July 2022 USDA NASS objective forecast, the 2022 Californian almond crop will amount to 2.6 B lbs., 7% down from the May subjective forecast. With a slightly shorter than expected crop, the remaining inventory and new crop pricing are anticipated to increase.

On the demand side, there is an understandable concern that the inflation will put a significant strain on household budgets, which is unavoidable. Looking back at previous financial crises and inflationary periods, consumption of confectionary, snacks, and eat-at-home items actually increased as consumers cut back on other things like vacations, new cars, restaurants, or even cinema trips. Add to that the fact that almonds (and other nuts) are a very cheap source of ‘storable’ protein at a time when all other food prices are rising. In the short term, there is a lot of concern about what is coming, and retailers are being very cautious about ordering from their suppliers/making additional commitments, although a lot of enquires are being received.

Figure 9. Almond Historical Pricing FAS California (USD/pound). (a) 20-year series (July 2002-July 2022); (b) June 2016-June 2022. Source: Derco. (c) California Almond Total Supply (Millions of pounds). Source: Almond Board of California (*2021/22 YTD June 2022 ABC Report).

Prices have dropped by around $0.05-0.10/lb. over June (Figure 9) for the majority of items, and to a smaller extent for those with restricted availability, which has provided purchasers with a strong chance to profit from more aggressive sellers looking to reduce their inventory levels. In July, with a manageable inventory, stronger shipment figures and lower than anticipated crop, pricing has increased and the industry anticipates at least a stable to a potentially firming price trend (Figure 9a).